A number of indicators give us an new wave programs, llc idea as to the future, specifically, competitive pricing, global accounting standards, the globalization of accounting software and changing technology. Top Indian outsourcing firms like QX Accounting Services implement robust data security measures and adhere to strict confidentiality protocols to protect sensitive client information. Outsourcing bookkeeping services to India offers significant cost savings, with the potential for a 40-50% cost reduction. Indian outsourcing companies provide flexible staffing options, allowing firms to quickly adjust their bookkeeping needs. This eliminates the need for extensive hiring and training processes, making it easier for firms to accommodate a growing client base.

What are the benefits of outsourcing and specifically, use of the firm’s BMC SaAS division?

Thirdly, the time zone advantage allows for round-the-clock services and quicker turnaround times. This incident serves as a reminder of the importance of thoroughly discussing security measures before outsourcing any sensitive financial tasks. Data security is crucial in the current digital environment since there are many cyber threats.

Language Proficiency and Time Zone Advantage: Seamless Communication, Round-the-Clock Support

Additionally, outsourcing companies use secure encryption technologies and have permission levels to restrict access to sensitive information. Ultimately, outsourcing can be a valuable strategy for businesses looking to streamline operations and boost productivity. Please contact Pankaj Dave, partner at BMC Support & Accounting Services, a leading local firm that has offices in many of India’s largest cities. Tax season is synonymous with long hours and complex workloads for CPA firms and accounting professi… India is a developing country, so it has a lower cost of living and labor charges compared to most other developed nations. Bank how to set up payroll for your small business in 9 steps reconciliation is a crucial step in bookkeeping to ensure accuracy and identify discrepancies between a company’s records and bank statements.

Get a Free Strategy to Transform Your Business Operations

Additionally, companies should inquire about the physical security measures in place at the outsourcing provider’s facility, such as surveillance systems and restricted access to data centers. Regular security audits and compliance with industry standards should also be thoroughly discussed. Indian outsourcing providers provide custom solutions to meet the specific needs of businesses of all kinds, from start-ups to large enterprises. Outsourcing partners in India provide the scale and flexibility needed to support increased innovation, regardless of whether businesses are looking to streamline existing strategies or expand their accounting what is certified payroll features. A large number of very qualified accounting professionals, including those with ACCA, CMA, and CPA certificates, are available in India.

- In this section, we will discuss some key steps that CPA and accounting firms can take to find trustworthy and competent bookkeeping services in India.

- Based in Ahmedabad, India, with offices in the US, the Philippines, and East Africa, the company has clients all over the world.

- In today’s time, all successful accounting and CPAs need a strong infrastructure to enable proper functioning.

- Ultimately, outsourcing can be a valuable strategy for businesses looking to streamline operations and boost productivity.

- By tapping into India’s outsourcing capabilities, CPA firms can focus more on core business activities and client relations, leaving the intricate, time-consuming tasks to trusted offshore professionals.

- Today, India is probably the most populous country in the world with young, English-speaking and skilled people.

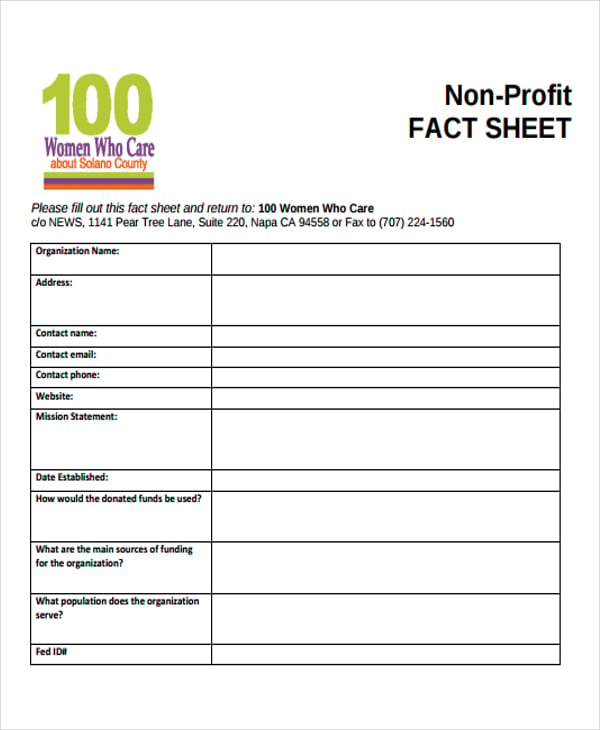

For more information on the outsourcing of accounting and bookmarking services to a trusted member firm in India, please contact Pankaj Dave at B.M. While BMC’s accountants will prepare the accounting records and tax returns, the firm will continue to deal directly with the client. All records will be subject to the firm’s final review, approval and will be communicated only by the firm to their client.

We specialize in accounting and bookkeeping services along with other service niches like taxation and payroll. Our company can handle various clients simultaneously and has the latest accounting tools and software to handle their needs. Our company has a distinguished team of Chartered Accountants and Financial Analysts, who have the enthusiasm and drive to provide the best solution for our clients.

CPAs and accounting firms, particularly those operating on a small or medium scale, do not have an abundant resource of employees and computerized systems. Such are the top accounting outsourcing companies such as Mindspace Outsourcing Services, which will help your firm with specific productivity. Contact us today to explore how our expert team at QX Accounting Services can help you harness the benefits of cost savings, scalability, and access to skilled professionals. To ensure the protection of sensitive financial information, it is crucial for CPA and accounting firms to have discussions with outsourcing bookkeeping companies in India regarding security measures.

.jpeg)

.jpeg)