A retainer is a fee paid to a lawyer or law firm in advance of services being rendered, and the law firm should hold it in a trust account until the services are provided. It gets booked to the balance sheet as a prepaid expense (which is an asset). As the billings occur against the prepaid asset, it is reduced and the billings are recognized/accounted for on the income statement as expenses. Consulting firms utilize diverse retainer models to ensure a stable cash flow and maintain client relationships. Tailoring these to client needs is crucial for the smooth management of retainer fees and advanced payments.

Frequently Asked Questions – Retainer Fees Defined and Explained

If the lawyer wins the case, he can charge his fees and adjust the receivables against the retainer amount. To understand the importance of retainer fees, let us take an example wherein the client appoints a lawyer to handle the lawsuits of his business. Some businesses receive retainers or deposits from customers before performing any services. When they invoice customers for services, those invoices are paid using the money from the deposits.

Retainer Fees and Client Management

Retainer fees pose unique challenges in bookkeeping, requiring meticulous tracking to ensure financial statements accurately reflect the company’s conditions. Consulting firms must properly account for these payments, not just for compliance, but also for clear client communication. Consulting firms must establish explicit expectations with clients about the scope and terms of the retainer agreement. Details such as the duration of the service, the specific deliverables, and the retainer fee amount are crucial. Firms typically delineate these points in a formal contract, making sure both parties agree on what retainer accounting constitutes value delivery.

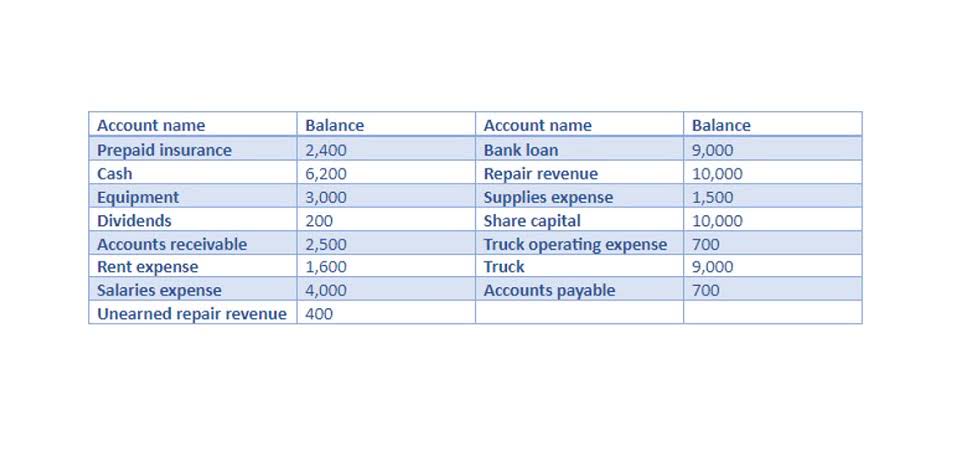

Step 1: Set up an account for upfront deposits or retainers

However, before answering it, let’s first dive into how a legal retainer works. Retainer fees can be calculated by estimating the hours needed to complete or maintain the project that the professional is hired for and multiplying it by their hourly rate. If the cost of a case is greater than your retainer, you may end up owing a balance. There are also many charter schools that are run separately from school districts.

It is the largest city in the United States by total area whose government is not consolidated with a county, parish, or borough. Though primarily in Harris County, small portions of the city extend into Fort Bend and Montgomery counties, bordering other principal communities of Greater Houston such as Sugar Land and The Woodlands. Not Returning Unearned Fees – Once a matter is closed, any remaining retainer amounts should be refunded to the client immediately. Again it is essential to remember that those funds are not yours, but merely being held by you in the client’s interest.

- This arrangement can be particularly beneficial for ongoing projects or long-term relationships where the scope of work is somewhat fluid but consistent.

- Professionals often start by estimating the number of hours they expect to dedicate to the client over a given period.

- The client and the service provider should know these before signing a retainer agreement.

- The Houston Dynamo is a Major League Soccer franchise that has been based in Houston since 2006, winning two MLS Cup titles in 2006 and 2007.

Legal and Ethical Implications

This arrangement is more likely when an attorney feels that the finances of a client are questionable, or at the start of a major project on behalf of a client, in order to cover the up-front costs of the attorney. The fee is also charged for other types of professional services, such as consulting. In addition to hourly rates, professionals must consider any additional costs that might arise during the course of the engagement. Incorporating these potential costs into the retainer fee helps prevent unexpected financial burdens and ensures that the professional is adequately compensated for all aspects of their work. Determining the appropriate retainer fee involves a blend of art and science, requiring a thorough understanding of the client’s needs, the scope of services, and the professional’s expertise. Professionals often start by estimating the number of hours they expect to dedicate to the client over a given period.

- The controller’s duties are to certify available funds prior to committing such funds and processing disbursements.

- An unearned retainer fee refers to the initial payment held in a retainer account before any services are provided.

- In managing bookkeeping for retainer fees and advanced client payments, consulting firms utilize an array of tools designed for precision and efficiency.

- If you are unsure if your retainer is exhausted, you can ask your lawyer for an itemized invoice listing all of the work that they have performed.

- It allowed clients to access a lawyer’s expertise and services on an ongoing basis rather than just for specific legal matters.

- For instance, if a project is taking longer than expected, discussing the financial implications early on can help in renegotiating terms or adjusting the retainer fee.

You can set up a deposit or retainer process for your company in QuickBooks Online. The retainer or deposit is treated as a liability to show that, although your business is holding the money from a deposit or retainer, it doesn’t belong to you until it’s used to pay for services. When you https://www.bookstime.com/ invoice the customer and receive payment against it, you’ll turn that liability into income. A retainer fee is a sum of money that a client pays an accountant or accounting firm in advance for future services. A retainer fee is the first deposit of money retained in a retainer account before they provide any services.

Best Practices in Retainer Fee Management

Expenses and items are now tracked by customer, enabling you to view transactions and their effect on the customer’s retainer. To reduce the number of results to view, you can change the report period to display a narrower date range or select the small triangle next to a customer’s name to collapse their details. At any moment, executives or team members may own public or private stock in any of the Accounting Periods and Methods third party companies we mention.

This estimation should be based on past experiences with similar projects or clients, taking into account any unique aspects of the current engagement. The process of recognizing revenue from retainers involves allocating the retainer fee over the period during which the service is expected to be performed. This allocation is based on estimates of how long the service will take or milestones achieved, depending on the nature of the engagement. For instance, if a retainer covers a year-long service agreement, a twelfth of the retainer fee would typically be recognized as revenue each month, assuming an even distribution of service provision.