While tax-exempt status might be determined by the IRS and federal law, nonprofit status is determined by state law. Because of this, the IRS requires that you obtain nonprofit status from your state before applying for tax-exempt status. For the most part, nonprofits can apply to the IRS to become exempt from federal taxes under Section 501.

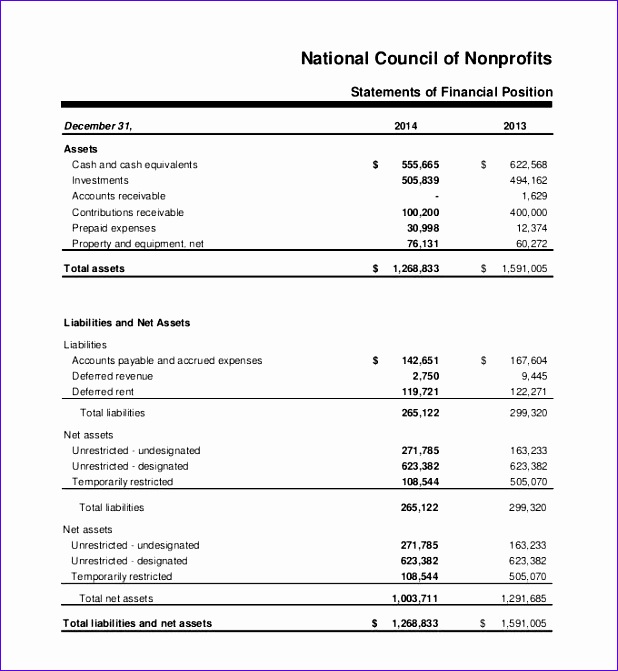

The Statement of Financial Position

Additionally, the section of additional disclosures may include information about related party transactions, contingent liabilities, and other relevant matters. These disclosures provide a comprehensive view of the organization’s financial position and help users of the financial statements make informed decisions. To effectively implement individual taxpayer identification numbers accounting policies, nonprofit organizations should establish internal controls and procedures. This includes segregating duties, conducting regular audits, and maintaining proper documentation. By having strong internal controls, nonprofit organizations can minimize the risk of fraud and errors in their financial statements.

Investing Activities

It is important for nonprofits to accurately record and report their revenue and support to maintain transparency and accountability. By doing so, they can demonstrate their financial stability and attract potential donors and funders. To present the liabilities in a structured manner, a Markdown table can be used. The table can include columns for the type of liability, the amount owed, and the due date. This provides a clear overview of the organization’s financial obligations and helps stakeholders make informed decisions. In the Statement of Financial Position, the assets section is typically presented in order of liquidity, with cash and cash equivalents listed first.

- You’ll also need to have a balance sheet and a snapshot of your organization’s finances at the beginning and end of the year when filing IRS tax form 990.

- Keep in mind that financial reporting should be accurate and consistent and reflect the true nature of the organization’s operations.

- The net assets are categorized into unrestricted, temporarily restricted, and permanently restricted funds, indicating the availability and limitations on these resources.

- Nobody wants to dig through the proverbial “shoebox” of receipts come reporting time.

- Financial statements give donors a better understanding of how your organization is doing.

- It gives insight into the organization’s financial performance and whether it is generating enough revenue to cover its expenses.

Expenses

Nonprofits have a primary responsibility to the Internal Revenue Service (IRS) and their donors when filing and sharing financial statements. Organizations must follow basic accounting practices when filing these statements and find ways to share these details in ways donors can understand. Nonprofit balance sheets give you an overview of your organization’s financial health.

What is a Nonprofit Balance Sheet?

Examples include bank balances, accounts receivable, pledged donations, investments, and prepaid expenses. Save the Children adds these financial statements and a letter from the independent auditor when providing financial reports. Board members and other leaders can use this statement for better insight into how much is available to pay expenses. Your net assets can be from the current and previous operating years and include anything that holds value.

A nonprofit’s cash flow statement provides information on how cash flows in and out of an organization on a regular basis. Typically pulled on a monthly basis, this report provides insight into the specific activities that are bringing funds into the organization, and how those funds are being spent. A statement of financial position is simply another term for a balance sheet; there is no difference. It reports an organization’s assets, liabilities, and net assets at a set point in time. For that reason, we default to talking about accrual basis accounting in this article.

Assets may include cash, investments, property, and equipment, while liabilities encompass debts, accounts payable, and other obligations. The net assets are categorized into unrestricted, temporarily restricted, and permanently restricted funds, indicating the availability and limitations on these resources. Understanding the nonprofit balance sheet is essential for stakeholders to assess financial health, liquidity, and the organization’s ability to fulfill its mission effectively. This method records revenue and expenses in accordance with nonprofit accounting standards.

Financial statements give donors a better understanding of how your organization is doing. Foundations also typically require nonprofits to provide financial statements when they apply for grants. Nonprofit financial statements are important because they provide transparency and accountability to stakeholders, including donors, grantors, and the public. They help assess the financial health of the organization and ensure proper management of resources. The Liabilities Section of the Statement of Financial Position provides important information about the financial obligations of a nonprofit organization.

There are four financial statements nonprofits must file every year to remain in compliance with the IRS. But don’t fret – although it sounds complicated, these standard financial statements are easy to compile with the right tools and guidance. In this article, we’ll walk you through the four types of statements and show you some examples of how other nonprofits handle their financial statements. Here’s an example (page 4) of a complete statement of financial position or balance sheet of a nonprofit to show how yours can look. The net income on an income statement for nonprofits is what remains after subtracting total expenses from total revenues.