Running a business comes with its fair share of financial challenges. Luckily, there are tools like the margin of safety calculator to help make sense of it all. It’s important to remember that the margin of safety you calculate for an investment is only as good as the intrinsic value calculation.

Premium Investing Services

Company 1 has a selling price per unit of £200 and Company 2’s is £10,000. For example, the same level of safety margin won’t necessarily be as effective for two different companies. But there is no standard ‘good margin of safety’ percentage or amount. The context of your business is important and you need to consider all the relevant elements when you’re working out the safety net for yours. Forecasts of future revenues are also helped by using information on current sales and expense data, making it useful for informing budgets and projections.

How do you calculate the margin of safety with our online calculator?

Alongside all your other data, you can use your margin of safety calculations to help with budgeting and investing decisions about your business. Just tracking your margin of safety month-to-month keeps your business, well, safer. You never get too near that break-even point, or tumble unknowingly into being unprofitable. It’s better to have as big a cushion as possible between you and unprofitability.

Top Tools

With a helpful online calculator, we will provide you with your business’s margin of safety, an important tool to measure profitability. It is important to note that with higher sales, the relative value of the operating costs to the sales may decrease because, with higher sales, the share of the fixed costs tends to decrease. The margin of safety calculator allows you to find out how much and if the sales surpass the break-even point. It is the basic accounting metric that every business owner needs to track to monitor his company’s performance.

- And whether you need to adjust your strategy in order to achieve profitability.

- The context of your business is important and you need to consider all the relevant elements when you’re working out the safety net for yours.

- However, while they might lead to an immediate uptick in revenue, it’s essential to recognize their potential impact on overall profitability and the margin of safety.

- The Margin of Safety (MOS) percentage measures how much sales can drop before a business reaches its break-even point, providing a buffer against financial losses.

- The closer you are to your break-even point, the less robust the company is to withstanding the vagaries of the business world.

- To determine if you have a margin of safety, you need to figure out if that is doable.

How do we increase the margin of safety?

- This is vital for business owners, managers, and investors to prevent financial pitfalls.

- The wider your margin of safety is, the better chance that overly optimistic valuation inputs won’t doom your investment.

- Knowing what is meant by margin of safety is thus vital for your business to survive.

- Businesses use this margin of safety calculation to analyse their inventory and consider the security of their products and services.

- Using the margin of safety to make investment choices — for example, only investing when it is greater than 20% — is often referred to as value investing.

Knowledge of the margin of security is used as guidance on the possibility of growth, expenditure, or prices. With help of your risk scale it will help you to understand whether you are ready to take more risks or should take precautions now. It helps professional virtual bookkeepers you understand how much leeway your business has before hitting a loss. This is vital for business owners, managers, and investors to prevent financial pitfalls.

The margin of safety formula

However, while they might lead to an immediate uptick in revenue, it’s essential to recognize their potential impact on overall profitability and the margin of safety. Let’s go back to Netflix to determine if it had a margin of safety following its stock price dive. Netflix’s current P/E is 18, but you believe the P/E ratio will increase to around the S&P 500 number of 24. In the long run, each company should keep its operating costs under control.

A too high ratio or dollar amount may make the management to make complacent pricing and manufacturing decisions. For multiple products, the weighted average contribution may not provide the right product mix as many overhead costs change with different product designs. For a single product, the calculation provides a straightforward analysis of profits above the essential costs incurred.

As we can see from the formula, the main component to calculate the margin of safety remains the calculation of the break-even point. The calculation of the break-even point then depends on the costing method adopted by the firm. For simplicity, the break-even point can be calculated as the contribution margin in dollar amount or in unit terms. So, while discounts and markdowns can be powerful tools to stimulate sales, they must be approached with caution and foresight. By leveraging financial modeling and diligently calculating the margin of safety, businesses can lower the risk of their strategies backfiring. In the competitive business landscape, offering discounts and markdowns is a common strategy to attract customers and boost sales.

This calculator will compute the margin of journal entry definition safety for a company in terms of both a percentage and amount of sales, given the company’s break-even point and its expected sales. In the world of business, smart decision-making often hinges on understanding critical financial metrics. The margin of safety, revered by many investors and business leaders, is one such metric.

Free Margin of Safety Calculator: Quick and Easy Online Tool

As such, it will determine what you need to be selling in order to reach break even point. And whether you need to adjust your strategy in order to achieve profitability. A higher margin of safety percentage provides more leeway in adjusting sales targets or absorbing potential downturns. It’s especially important for businesses aiming to ensure stability and mitigate risk. It’s also worth noting that not all products are equally profitable.

How to Calculate the Margin of Safety

If Netflix is destined to evolve into a no-growth company, a P/E of less than 18 may be realistic when you calculate its intrinsic value. Another way is to use what Expectations Investing authors Michael Maubossin and Alfred Rappaport call price implied expectations analysis. Instead of running a DCF with crazy numbers, you figure out what amount of growth is needed to justify the current stock price. Using the margin of safety to make investment choices — for example, only investing when it is greater than 20% — is often referred to as value investing. A stock with a 50% margin of safety will theoretically fall less than a stock with a slim margin of safety or none at all.

Formula

This multifaceted approach not only offers a safety net but also positions the business for growth, even in uncertain market landscapes. Now, circling back to the margin of safety – a high percentage offers comfort, suggesting that the current market price stands well below its perceived value, offering a cushion. Conversely, a low margin of safety raises caution, pointing to potential vulnerabilities should market conditions take an unexpected turn.

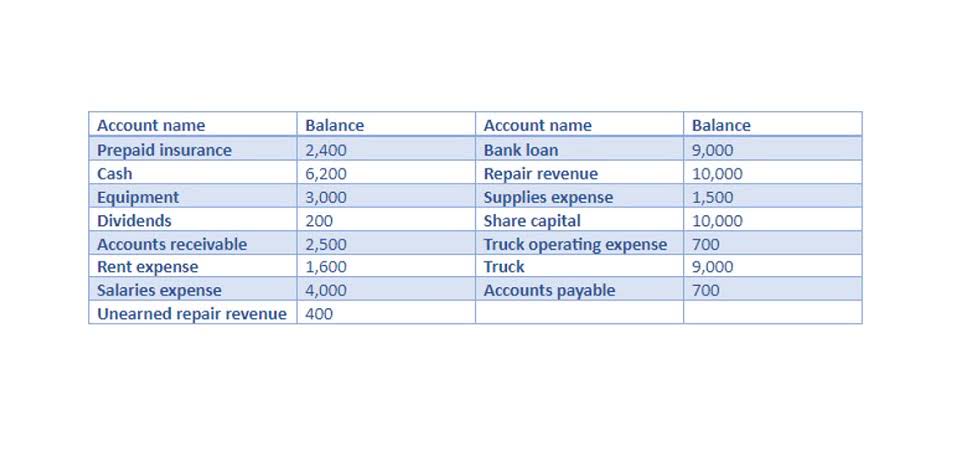

Enter the breakeven point which is how to prepare an income statement the value of sales at which you break-even that is when revenues equal cost. In order to calculate the margin of safely, we shall need to follow the three steps as mentioned above. In this section, we will cover two examples for the calculation of the margin of safely. The first example is for single product while the second example is for multiple products. It is crucial to focus on the effective prices, not the SRP prices.