But drinking too much alcohol of any color can still make you feel bad the next morning. Hangovers after a single night’s drinking go away on their own. Talk with your healthcare professional if you’re concerned that frequent heavy drinking may lead to serious problems, such as alcohol withdrawal. A hangover is a group of unpleasant symptoms that can happen after drinking too much alcohol.

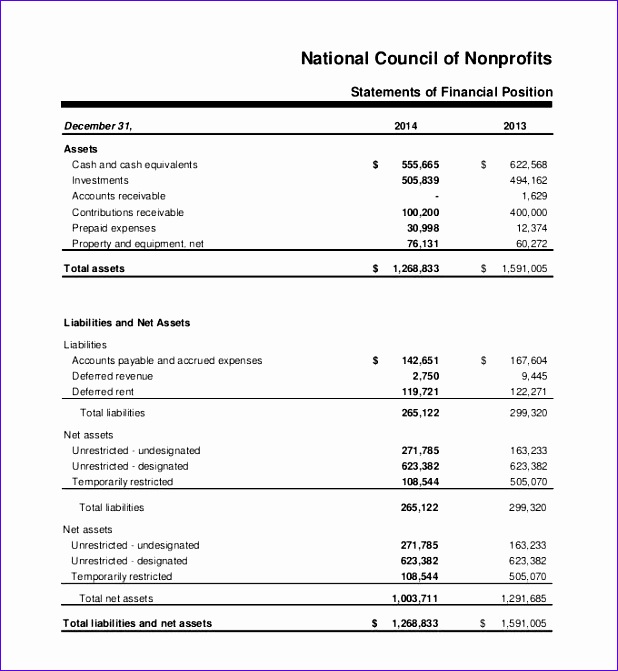

- Thus, the question of whether moderate coffee consumption can contribute to daily fluid requirement remains unanswered.

- Whether you drink water between each alcoholic drink, after drinking, or even the next day, it’s vital to replace lost fluids.

- Follow drinking behaviors that are best for you, not what everyone else is doing.

- Here’s what you need to know about how alcohol dehydrates the body and how to drink responsibly.

- Alcohol has long held a prominent place in many societies and cultures.

Table 1. Effect of caffeine consumption on urine production.

- This may lead to fat buildup, inflammation and, eventually, scarring of liver tissue.

- You may feel the effects of the alcohol sooner, but it can also amplify other effects, including dehydration.

- Alcohol will dehydrate you, which has adverse effects both in the short and long term.

Euphoria, relaxation, and other physical and mental changes are the result of alcohol’s impact on your central nervous system. To stay hydrated, a person needs to take steps before, during, and after alcohol consumption. These are substances that promote urine production, or diuresis. Yes, drinking electrolyte water is an excellent strategy to rehydrate after drinking alcohol. Alcohol can cause dehydration, disrupt sleep, interfere with energy production, and alter the body’s acid-base balance, all of which impact overall health and well-being.

Does Alcohol Dehydrate You? Understanding The Health Risks

Any participant whose caffeine intake from coffee fell outside of this range was not included in the study. Once you recognize that someone is dehydrated, Dr. Fertel recommends getting them out of the heat and giving them plenty of fluids. Whether it’s the start of summer vacation or you’re gearing up for an upcoming trip, many of us are excited to get outside and have fun in the sun — even in higher temperatures.

Heart problems:

- That’s why it’s important to increase water intake during hot weather or when you’re ill.

- If you don’t feel better from drinking plain water, try adding an electrolyte mix to water or drinking a low-sugar sports drink that contains electrolytes.

- The MV volume was added to the 24 h collection to give total 24 h volume data (V24).

- The night is off to a great start and you’re catching up with friends and family.

- She goes on to explain these nutrients also help you retain fluids, while chugging a bunch of water will cause much of it to pass through your system without properly rehydrating you.

A quick walk or just a few minutes of weight lifting can help turn your dehydration around. It goes without saying that you should combine these activities with a mineral and electrolyte-rich drink. Luckily, there are a few things you can try to stop dehydration from alcohol in its tracks. This is partly because our soil is incredibly depleted, so our fruits and veggies don’t have the mineral content they once did.

One large study found excessive alcohol consumption is linked to accelerated facial aging. But the type of alcohol you choose affects how dehydrated you become. “The darker the beverage or higher the alcohol by volume (ABV) concentration, the more dehydrating it can be,” says New York City-based addiction specialist Aaron Sternlicht, LMHC, CASAC.

Dehydration can cause mild symptoms like headache, dry mouth, dizziness, and fatigue, or severe issues like damage to the brain, heart, kidneys, and even death (1). Added sugar creates extra acid, which makes it harder for your body to store water. Salty foods, like chips and other snacks, are also risky when it comes to staying hydrated. You’re likely to urinate 100 mL more for every standard drink you consume (10 mL of alcohol). If you binge drink, you’ll likely lose 500 to 1,000 mL of fluids, causing dehydration. Unless you’re a fan of dry mouth, nausea and hangover headaches, you’ll likely do anything to avoid alcohol dehydration symptoms..

How can I prevent alcoholic ketoacidosis?

- When you’re feeling a hangover, it’s important to explore the root cause.

- Consuming foods with high water content, such as fruits and vegetables, can help counteract the dehydrating effects of alcohol.

- Interestingly, studies have shown that people over 50 overcome the suppression of ADH from alcohol more quickly than their younger counterparts.

- The advice provided in the public health domain regarding coffee intake and hydration status should therefore be updated to reflect these findings.

- If you are unable to adequately replace fluids on your own, you may need to see a doctor.

- If you have any additional complications during treatment, this will also affect the length of your hospital stay.

- Thirst isn’t always a reliable early indicator of the body’s need for water.

Many people, particularly older adults, don’t feel thirsty until they’re already dehydrated. That’s why it’s important to increase water intake during hot weather or when drinking alcohol and dehydration you’re ill. Dehydration occurs when you use or lose more fluid than you take in, and your body doesn’t have enough water and other fluids to carry out its normal functions. Water intake can be something we overlook, especially when we’re outside having fun.