Further, we provided a simpler format that identifies a company’s accounts receivable on a single row. However, suppose your business sends higher volumes of individual invoices to customers over a month. In that case, you’ll likely choose a more detailed format with additional rows that break out the owed amounts by specific invoice.

Accounts Receivable Aging

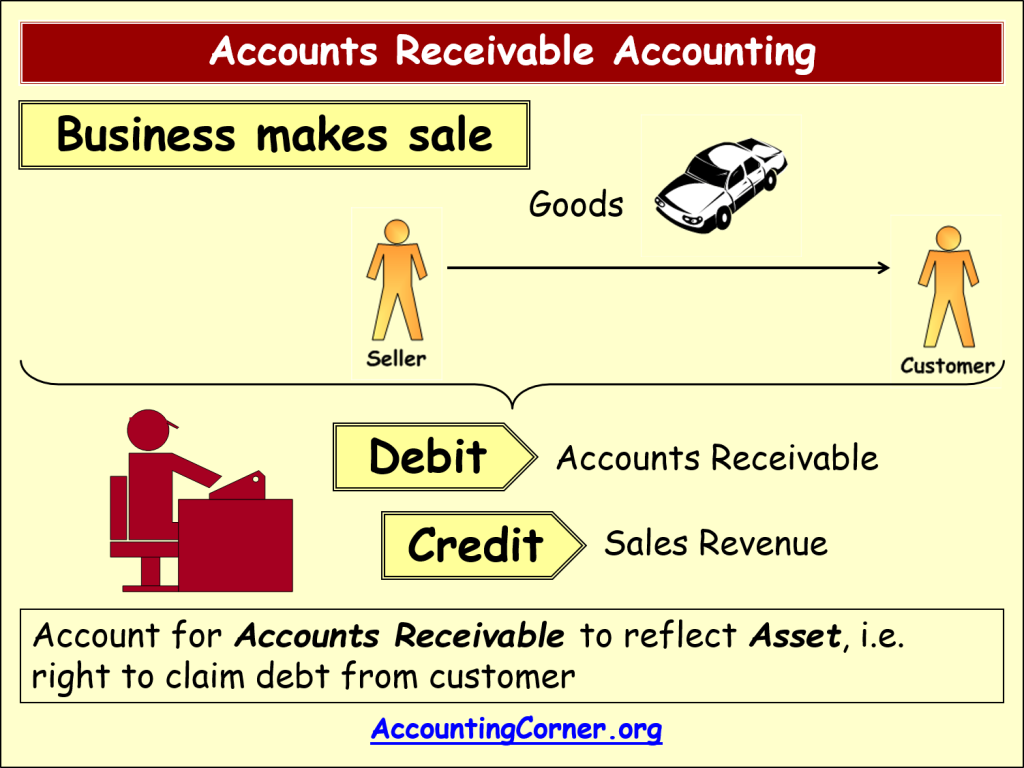

As per the above journal entry, debiting the Cash Account by $200,000 means an increase in Cash Account by the same amount. Debiting accounts receivable with $200,000 means an increase in accounts receivable by the same amount. Customers are more likely to buy items if they can pay for them at a later date. The average AR days measure is an important part of forecasting changes in non-cash working capital in financial modeling.

What are the impacts of accounts receivable on the financial statements?

Colloquially, the term “accounts receivable” is also frequently used to refer to the related departments, personnel, and systems responsible for managing and tracking these unpaid debts. The management makes an estimate in respect of the amount of accounts receivable that will never be collected from the customers. This estimate is then recorded as allowance for doubtful accounts and is used to offset tax considerations for college students 2020 accounts receivable. Accounts receivable is recorded as the current asset on your balance sheet, as you are liable to receive cash against such receivables in less than one year. However, there is an element of risk attached to accounts receivable, especially if you are yet to receive cash against such credit sales. Therefore, it is important that you manage your accounts receivable carefully.

Accounts Receivable FAQs

Late payments from customers are one of the top reasons why companies get into cash flow or liquidity problems. Here we’ll go over how accounts receivable works, how it’s different from accounts payable, and how properly managing your accounts receivable can get you paid faster. Automating your Accounts Receivable process can improve efficiency and accuracy. FreshBooks accounting software offers an easy way to automate key aspects like invoice generation, late payment notifications, and payment processing. Try FreshBooks free to discover how the right accounting software can help you streamline your Accounts Receivable workflow today. If your invoice matches the agreed-upon terms in the sales order, you should have a legally binding agreement.

Example of Accounts Receivable

At some point along the way, interest on the debt might also begin to accrue. Receivables are broadly classified into trade-receivables and non-trade receivables. Trade receivables are those receivables which originate from sales of goods and services by a business in the ordinary course of business.

Customers at a grocery store or restaurant pay right away with cash or a card. But businesses that sell big-ticket or bulk items might not get paid for months. To see how you’re doing, compare your turnover ratio to other businesses in your industry. Average accounts receivable is the beginning balance + ending balance divided by two.

It’s common for companies to report AR along with an allowance account for receivables that management doesn’t think will be collected. The allowance for doubtful accounts has a negative balance that decreases the outstanding AR balance. This contra asset reduces the balance in AR similar to how accumulated depreciation reduces fixed assets’ carrying value.

In our illustrative example, we’ll assume we have a company with $250 million in revenue in Year 0. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy. Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association.

Allowance for doubtful accounts is a contra account on receivables balance and shown in the balance sheet as a negative current asset. Accounts receivable is the money that customers owe a business for goods or services that have been delivered but not yet paid for. Once you’re done adjusting uncollectible accounts, you’d then credit “accounts receivable—Keith’s Furniture Inc.” by $500, also decreasing it by $500. Because we’ve decided that the invoice you sent Keith is uncollectible, he no longer owes you that $500. If you have a good relationship with the late-paying customer, you might consider converting their account receivable into a long-term note. In this situation, you replace the account receivable on your books with a loan that is due in more than 12 months and which you charge the customer interest for.

- Accounts receivable are an asset account, representing money that your customers owe you.

- CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)® certification program, designed to transform anyone into a world-class financial analyst.

- The days sales outstanding (DSO) measures the number of days on average it takes for a company to collect cash from customers that paid on credit.

- Hence, the company might need to estimate the uncollectable amount which is called “allowance for doubtful accounts”.

An account receivable is documented through an invoice, which the seller is responsible for issuing to the customer through a billing procedure. The invoice describes the goods or services that have been sold to the customer, the amount it owes the seller (including sales taxes and freight charges), and when it is supposed to pay. Net receivables is an accounting term for a company’s accounts receivable minus any receivables it has reason to believe it will never collect. It is typically expressed as a percentage of uncollectible debts relative to collectible ones, and the lower the percentage, the better. Further analysis would include assessing days sales outstanding (DSO), which measures the average number of days that it takes a company to collect payments after a sale has been made. Accounts receivable are an important element in fundamental analysis, a common method investors use to determine the value of a company and its securities.

For most of these methods, businesses will need a merchant account and in many cases a payment processor. You may also choose to use accounting software like FreshBooks that integrates with payment processors so customers have an easy way to pay their invoices online. Offering several easily accessible payment options can help reduce the likelihood of late or unpaid invoices. The Accounts Receivable process is important because it allows businesses to accurately track and collect customer payments. This ensures that cash flow remains steady and that no unpaid invoices get missed. Accounts receivable (AR) is an accounting term for money owed to a business for goods or services that it has delivered but not been paid for yet.